CEO of Rent-A-Center: Franchise Cost and Profit Revealed (2025)

Is Rent-A-Center Franchise a profitable business option to consider? Reveal the answer on this article by VettedBiz

Table of Contents:

Rent-A-Center is an American public furniture and electronics rent-to-own company based in Plano, Texas. The company focuses on providing ownership of high-quality, durable products under flexible lease purchase agreements. In addition, in states with favorable laws, a small number of our Rental Stores offer financial services, including payday loans and title loans.

The company was incorporated in 1986 and as of 2014 operates approximately 2,972 company-owned stores in the United States, Puerto Rico, and Mexico, accounting for approximately 35% of the rent-to-own market in the United States based on store count. The company’s strategic initiatives have strengthened its market position over the years. The company named Mitch Fadel as its new Chief Executive Officer, after serving as President and Chief Operating Officer, replacing Mark E. Speese. Before his appointment, the company had an interim CEO to ensure smooth leadership transition. RAC has affiliates Get It Now, Rainbow Rentals, Rent Rite, RentWay, and Home Choice. The company operates through various segments, including U.S. Pawn and Latin America Pawn, offering services such as pawn loans and retail products. The Chief Financial Officer plays a crucial role in driving the company’s financial performance and growth.

Over the past 9 years, Rent-A-Center unit count has decreased from 3,205 to 2,369, representing a decrease of 26%!

How Is Rent-A-Center Franchise Positioned in the Rent to Own Business and Retail Products and Services Industry?

The U.S. Retail Products and Services industry is well-established and depends on a strong distribution channel for all types of retail companies. The market provides several different goods such as food, apparel, furniture, jewelry, and many others. The retailer’s subsector within the industry employs 1 out of 5 Americans. In addition, independent and privately held retail businesses account for 95% of the whole retail industry. For retail companies, the holiday seasons are the most important time of the year. Rent-A-Center’s strategic initiatives are further supported by its parent company, Upbound Group Inc, which focuses on enhancing customer experiences and operational efficiency.

Online retailing continues to be the fastest-growing segment, with e-commerce emerging as the major shopping platform. The sector is expected to grow 9% annually, reaching $1.3 trillion by 2030. In addition, retail companies must continue to embrace technologies and automation in order to better leverage growth. Even expecting a growth of 2.2%, slower than previously anticipated at 2.5%, the market still has space to transform itself and encourage consumer spending. The Upbound Group plays a significant role in Rent-A-Center’s efforts to adapt and grow in the competitive retail market.

How Much Is a Rent-A-Center Franchise?

The initial Franchise Fee is $35,000. You have to pay this upfront fee when opening a Rent-A-Center franchise.

Rent-A-Center Franchise Cost

The estimated total investment necessary to begin the operation of the franchise ranges from $355,000 to $560,000.

Rent-A-Center Franchise Requirements

- The minimum liquid capital to own a Rent-A-Center franchise is $1,000,000 to $1,300,000.

- The net worth required is $750,000 to $3,000,000.

- The length of the initial franchise term is 10 years.

Owning a Rent-A-Center Franchise Requires Ongoing Fees

Royalty: 6% of Gross Sales

Marketing Fee: 3% of Gross Sales

The royalty fee for Rent-A-Center is a little higher compared with the 5.7% in the Retail Products and Services industry as a whole, and the marketing fee is also comparably higher compared to the 2.5% of gross sales in the entire sector.

How Much Do Rent-A-Center Franchise Owners Make?

2020 Sales Figures and Break-Even Point:

Royalty Fee: 6% of Gross Sales

Marketing Fee: 3% of Gross Sales

Estimated Franchise Sales: $33,358,333

Estimated Average Revenue: $722,042

| Initial investment (midpoint) | %Profit margin of median franchise sales | Estimated Profits | Time to recoup investments |

|---|---|---|---|

| $457,500 | 10% | $72,204 | 7.5 years |

| $457,500 | 15% | $108,306 | 5.5 years |

| $457,500 | 20% | $144,408 | 4.5 years |

2021 Sales Figures and Break-Even Point:

Royalty Fee: 6% of Gross Sales

Marketing Fee: 3% of Gross Sales

Estimated Franchise Sales: $2,265,450,661

Estimated Average Revenue: $1.12M

| Initial investment (midpoint) | %Profit margin of median franchise sales | Estimated Profits | Time to recoup investments |

|---|---|---|---|

| $457,500 | 10% | $112,000 | 5.5 years |

| $457,500 | 15% | $168,000 | 4.5 years |

| $457,500 | 20% | $224,000 | 3.5 years |

Based on the median sales provided by franchise locations, at an average of a 20% profit margin it will take around 3.5 years to recoup your investment. The time to recover the initial investment might be more than 5 years, but it is still relatively short if the business is profitable.

This is just an estimate of sales based on the franchisor’s income statement and can vary greatly depending on the length that the particular franchise location has been open and how well it is run.

Rent-A-Center Units Changed During the Past Years

Based on the statistics on Entrepreneur, the number of stores of Rent-A-Center did not act as a good indication for the company. As we could see from the graph, since around 2015 the number of units has continually decreased, which, to a certain degree, shows that the franchise might not be profitable.

Is the Rent-A-Center Franchise Profit Worth the Franchise Cost

As seen in the sales figures above, it takes a relatively short time to recoup your investment if you own a Rent-A-Center. It will take 5 years on average with a profit margin of 12.8%, which is the operating profit margin in 2021.

As there is no Rent-A-Center franchise that is on sale now, based on our estimation, when you go to sell a unit based on the median multiple of 0.54 and net sales averaging $1,120,000, it would sell for $604,800. This is higher than the midpoint initial investment of $457,500. Hence, overall, although it might take a long time (more than 5 years) to recover the initial investment, the investors could still resale their units to recover its initial costs and even make some profits.

Rent-A-Center Income Statement Key Insights

| 2021 | 2020 | ||

|---|---|---|---|

| Revenues | |||

| Store | |||

| Rentals and fees | $3,522,453 | $2,263,091 | $2,224,402 |

| Merchandise sales | 829,222 | 378,717 | 304,630 |

| Installment sales | 73,585 | 68,500 | 70,434 |

| Other | 4,148 | 3,845 | 4,795 |

| Total store revenues | 4,429,408 | 2,714,153 | 2,604,261 |

| Franchise | |||

| Merchandise sales | 126,856 | 80,023 | 49,135 |

| Royalty income and fees | 27,187 | 20,015 | 16,456 |

| Total revenues | 4,583,451 | 2,814,191 | 2,669,852 |

| Cost of revenues | |||

| Store | |||

| Cost of rentals and fees | 1,260,434 | 655,612 | 634,878 |

| Cost of merchandise sold | 935,765 | 382,182 | 319,006 |

| Cost of installment sales | 25,637 | 24,111 | 23,,383 |

| Total cost of store revenues | 1,260,434 | 655,612 | 634,878 |

| Franchise cost of merchandise sold | 126,603 | 80,134 | 48,514 |

| Total cost of revenues | 2,348,439 | 1,142,039 | 1,025,781 |

| Gross profit | 2,235,012 | 1,672,152 | 1,644,071 |

| Operating expenses | |||

| Store expenses | |||

| Labor | 644,763 | 579,125 | 630,096 |

| Other store expense | 770,073 | 609,370 | 617,106 |

| General and administrative expenses | 194,894 | 153,108 | 142,634 |

| Depreciation, amortization and write-down of intangibles | 54,830 | 56,658 | 61,104 |

| Other charges and (gains) | 289,913 | 36,555 | (60,728) |

| Total operating expenses | 1,954,473 | 1,434,816 | 1,390,212 |

| Operating profit | 280,539 | 237,336 | 253,859 |

| Debt refinancing chares | 15,582 | 2,168 | |

| Interest expense | 70,874 | 15,325 | 31,031 |

| Interest income | (221) | (768) | (3,123) |

| Earnings before income taxes | 194,304 | 222,779 | 223,783 |

| Income tax expense | 59,364 | 14,664 | 50,237 |

| Net earnings | 134,940 | 208,115 | 173,546 |

| Basic earnings per common share | 2.37 | 3.84 | 3.19 |

| Diluted earnings per common share | 2.02 | 3.73 | 3.10 |

| Cash dividends declared per common share | 1.27 | 1.18 | 0.54 |

The company is very profitable for the franchisor with a net income of $4,378,896 in 2020. Compared to the $1,439,743 net income in 2019, they saw a dramatic 200% increase from 2020 to 2021. This is a good indication of high growth as a company overall.

Rent-A-Center Recent Earnings Key Insights

During the year 2022, based on the information provided by the Rent-A-Center official website, the overall revenues and sales in the year 2022 were worse compared to 2021. In 2022, except for the first quarter when the revenues increase by 11.9% compared with the first quarter in 2011, the revenues in the second quarter decreased by 10.3%, and the revenues in the third quarter decreased by 13.3% compared with the same quarter in 2021.

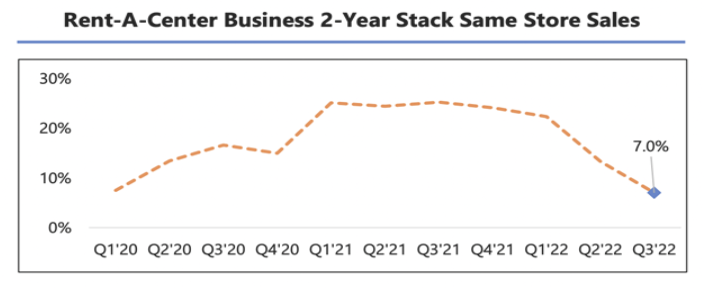

Additionally, in the following graph, we could find that the sales in the same store are continually decreasing since the start of the year 2022. These might indicate potential unprofitability and risk to owning a new unit now.

Additionally, besides the revenues and the sales, the adjusted EBITA in the year 2022 is also worse compared with 2021 for several different reasons. According to the analysis of their official website, in the first quarter, the adjusted EBITA decreased by 28.3% compared with the adjusted EBITA in the first quarter of 2021 due to an increase in delinquency and loss rates caused by customers’ discretionary income pressures and higher operating expenses.

In the second quarter of 2022, the adjusted EBITA is 31.1% lower compared with the second quarter of 2021 for the same reason as the first quarter. In the third quarter of 2022, the adjusted EBITA decreased by 34.6% compared with the third quarter of 2021 because of lower revenue and higher loss rates caused by pressure on customer discretionary income.

However, although there are significant decreases in revenues, sales, and adjusted EBITA, which might act as a bad indication of opening a franchise. Their “failure” in 2022 could partly be attributed to inflation and the overall economic recession in the U.S., which will reduce the public’s willingness to spend money in Rent-A-Center. Therefore, it might indicate that when the economy recovers, the profitability will recover and even increase.

Rent-A-Center Stockholders (2022)

The top three holders are Fidelity Management & Research Company LLC, BlackRock Institutional Trust Company, N.A., and The Vanguard Group, Inc. These three top buy-side companies, in the financial market, investment in Rent-A-Center, to a certain extent, shows their confidence in the company, demonstrating its potential profitability, well-capital structure, and a clean financial situation. Especially, except for BlackRock Institutional Trust Company N.A., both Fidelity Management & Research Company LLC and Vanguard Group, Inc. increased their shareholdings even though their overall profitability decreased during 2022. Hence, it seems that it would be a “safe” investment to open a franchise.

| Shares Held | %O/S | Share Change | Filling Date | |

|---|---|---|---|---|

| Fidelity Management & Research Company LLC | 8,322,421 | 14.95 | 772,555 | 9/30/22 |

| BlackRock Institutional Trust Company | 7,615,048 | 13.68 | -145,521 | 9/30/22 |

| The Vanguard Group, Inc | 5,945,974 | 10.68 | 66,728 | 9/30/22 |

| Allred (Aaron R) | 5,151,978 | 9.25 | 2,894,585 | 9/30/22 |

| Engaged Capital, LLC | 3,604,216, | 6.47 | 1,039,672 | 4/11/22 |

| State Street Global Advisors (US) | 2,108,689 | 3.79 | -41,499 | 12/9/22 |

| IEQ Capital LLC | 1,990,108 | 3.57 | -66,225 | 9/30/22 |

| Dimensional Fund Advisors, L.P | 1,265,796 | 2.22 | 67,142 | 9/30/22 |

| Geode Capital Management, LLC | 963,373 | 1.73 | -9,857 | 9/30/22 |

| LSV Asset Management | 869,860 | 1.56 | 51,800 | 9/30/22 |

Stock Performance

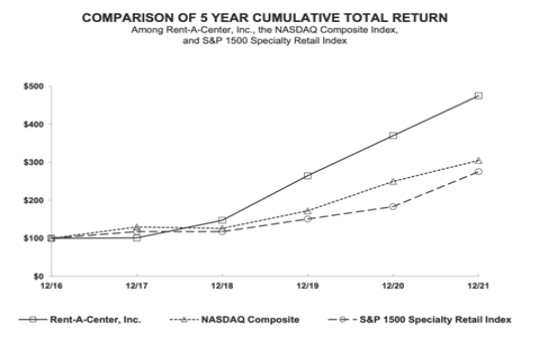

From the 2022 Proxy Statement/2021 Annual Report, we could find that until the end of 2021, the total return of the stock of Rent-A-Center in the stock markets increased relatively faster than two U.S. main stock indexes–NASDAQ Composites and S&P 1500 Specialty Retail Index. This shows that within the entire retail sector, the brand has relatively higher returns and profits compared with other companies.

Hence, if you want to invest in a retail franchise, it would be a good choice in this regard.

Training and Support for Rent-A-Center Franchise Owners

Rent-A-Center, Inc. is committed to ensuring the success of its franchise owners in the rent-to-own business. The company offers a robust training and support program designed to equip franchisees with the knowledge and tools they need to thrive.

- Initial Training the franchise provides an intensive initial training program that covers all aspects of the business. This includes sales techniques, customer service best practices, and operational procedures, ensuring that new franchise owners are well-prepared from day one.

- Ongoing Support The support doesn’t stop after the initial training. They offers ongoing support through regular meetings, webinars, and training sessions. This continuous education helps franchise owners stay updated on the latest retail trends and business strategies.

- Business Development Rent-A-Center’s business development team plays a crucial role in helping franchise owners grow their businesses. This team works closely with franchisees to identify opportunities for revenue growth and to implement effective business strategies.

- Marketing Support Effective marketing is key to attracting and retaining customers. Rent-A-Center provides comprehensive marketing support, including advertising campaigns, social media strategies, and public relations efforts. This ensures that franchise owners can effectively promote their stores and drive customer engagement.

- Operations Support Managing day-to-day operations can be challenging, but Rent-A-Center’s operations team is there to help. They provide guidance on inventory management, customer service, and store operations, ensuring that franchisees can run their businesses smoothly and efficiently.

By offering such extensive training and support, Rent-A-Center demonstrates its commitment to the success of its franchise owners, making it a compelling option for those looking to enter the rent-to-own industry.

Marketing and Advertising Strategies

The company employs a diverse array of marketing and advertising strategies to effectively reach its target audience and promote its products and services. These strategies are designed to maximize visibility and drive customer engagement across multiple platforms.

- Social Media Maintaining a strong presence on platforms such as Facebook, Twitter, and Instagram, the company engages with customers, shares promotions, and builds brand loyalty.

- Online Advertising Leveraging tools like Google Ads and Facebook Ads, the company targets specific demographics and drives traffic to its stores and website. This digital approach allows for reaching a broad audience efficiently.

- Print Advertising Despite the rise of digital media, print advertising remains valuable. Ads are placed in newspapers and magazines to reach potential customers who prefer traditional media.

- Television Advertising To reach a wider audience, the company invests in television advertising, showcasing products and services, and highlighting the benefits of the rent-to-own model.

- Public Relations Enhancing its brand image through public relations, the company communicates key messages by issuing press releases, engaging in media outreach, and participating in community events.

By utilizing a mix of social media, online, print, and television advertising, along with strong public relations efforts, the company ensures that its marketing strategies are comprehensive and effective in reaching its target audience.

Competition and Market Analysis

The rent-to-own sector is a competitive landscape, with several major players vying for market share. Rent-A-Center stands out as one of the largest companies in this sector, but it faces significant competition from other established brands.

- Aaron’s, Inc. Aaron’s is a leading provider of rent-to-own options. With a strong market presence, Aaron’s is a key competitor.

- Conn’s, Inc. Conn’s operates as a retailer of electronics, offering rent-to-own options. This makes Conn’s another significant competitor in the market.

- Rent-A-Center’s Market Share Rent-A-Center holds a substantial market share, accounting for approximately 35% of the rent-to-own market in the United States. This dominant position underscores the company’s strong brand recognition and extensive store network.

- Market Trends The rent-to-own market is expected to continue growing, driven by increasing demand for affordable consumer electronics and appliances. This growth presents opportunities for Rent-A-Center to expand its market presence further.

- Competitive Advantage Rent-A-Center’s competitive advantage lies in its comprehensive training and support program for franchise owners, strong brand recognition, and extensive store network. These factors contribute to the company’s ability to attract and retain customers, even in a competitive market.

By understanding the competitive landscape and leveraging its strengths, Rent-A-Center is well-positioned to maintain its leadership in the rent-to-own market and capitalize on future growth opportunities.

Conclusion

Investing in a Rent-A-Center franchise is an interesting opportunity, especially for individuals looking to make their way into the Retail market. The prospects for growth and success within the industry and the brand itself are extensive, and some markets continue to be available as they move forward with growing their presence across the country.

If you are an individual with a passion for owning a restaurant and are willing to invest an amount ranging from $355,000 to $560,000 or more, Rent-A-Center might be the right fit for you.

We strongly recommend you speak to at least 5 franchisees to better understand the financials (see questions to ask).