Franchise Lending: Top SBA Lenders

Unlock the potential of franchise ownership with our guide to the top SBA lenders! Discover essential financing options and expert insights that can transform your dream into reality. Click to explore how the right financial partner can drive your success!

Table of Contents:

Introduction

Embarking on the journey of franchise ownership is an exhilarating venture, promising boundless opportunities for success and financial growth. However, securing the right franchise financing is often the linchpin that propels this dream into reality. In the world of franchise loans, selecting the right partner is paramount.

In this comprehensive guide, we delve into the cream of the crop in franchise financing, shedding light on the top 3 most active SBA Lenders that have earned their stripes in the industry. Their unwavering commitment to supporting entrepreneurs has propelled them to the forefront of the market. Moreover, we will explore the various types of loans they offer, each tailored to address the unique needs of franchisees.

Top SBA Lenders for Franchise Lending by Market Share Powered by Lumos

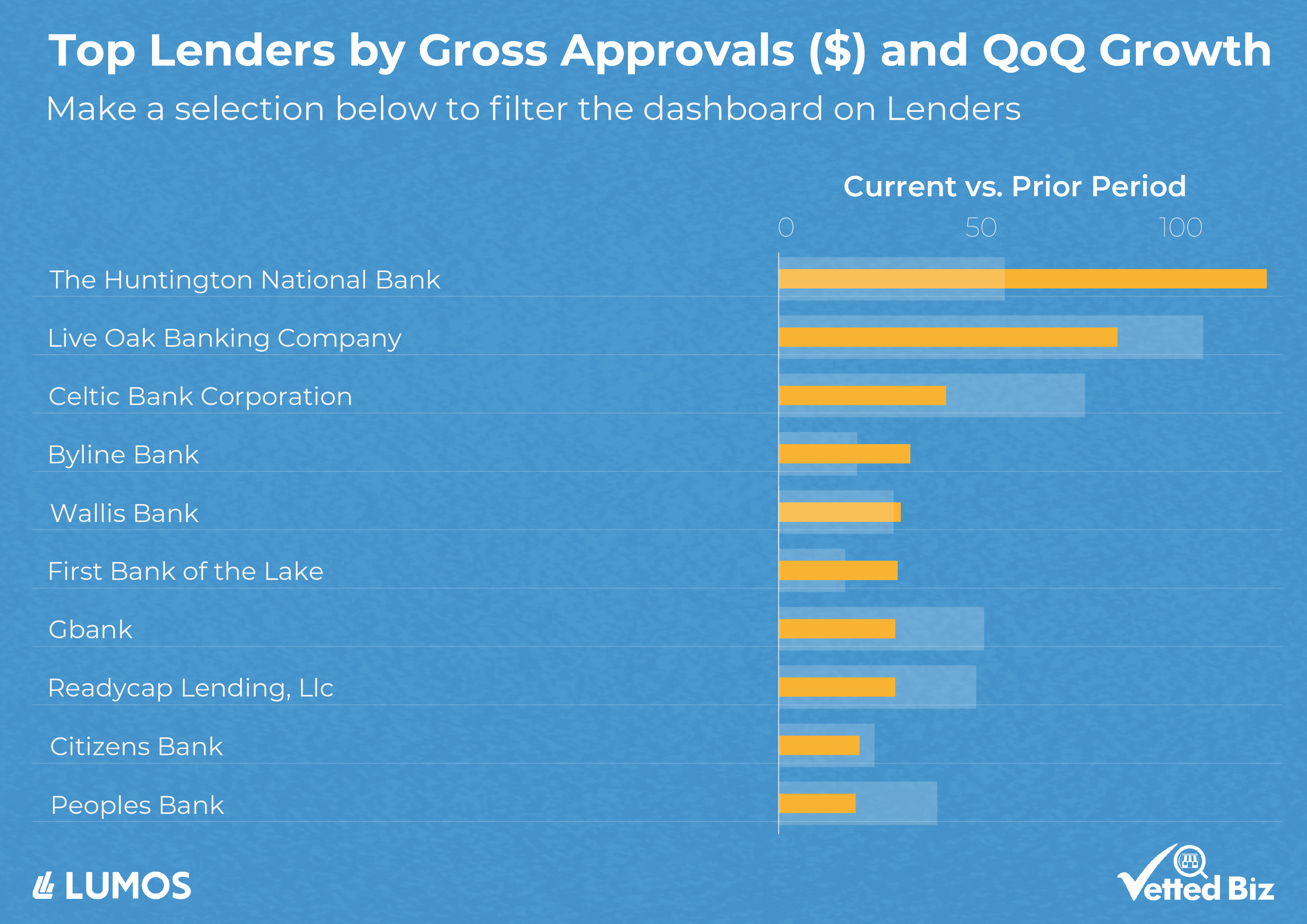

When it comes to franchise lending, a select group of institutions stands out as leaders in the field. Among these, Huntington Bank, Live Oak Bank, and Celtic Bank have emerged as prominent players, each contributing significantly to the market. Notably in FY 2023 Q3, Huntington Bank reached $120.3M in gross approvals, demonstrating its substantial influence in SBA franchise financing. Following closely behind is Live Oak Bank, with $83.5M, while Celtic Bank secures its position with a noteworthy $41.3M. These institutions have distinguished themselves through their commitment to providing vital financial support to aspiring franchisees, solidifying their status as key players in the industry.

Deep dive into the Top 3 Lenders

Huntington Bank:

Huntington’s performance in the franchise lending sector in Q3 2023 reflects a noteworthy trend. In terms of dollar value approved, Huntington Bank’s gross approvals are up nearly 114% quarter over quarter indicating its significant financial involvement in supporting franchise ventures. Furthermore, Huntington Bank’s commitment to support businesses of all sizes is evident, with their loan volumes ranging from the smallest (<$25K) to ($3M).

Displayed below are Huntington’s leading franchises ranked by gross approvals with quarter-over-quarter (QoQ) growth, with X-Golf securing the top position, with $7.8M in gross approvals in Q3 2023.

The Huntington Bank is a prominent player in the franchise lending sector, with a nationwide presence dedicated to supporting small businesses. The bank’s extensive network and tailored financial solutions have earned them a reputation as a reliable ally for small businesses seeking funding. As evidenced by the graphic below, Huntington Bank’s impact is felt across various states, further solidifying their position as a key player in the franchise financing industry.

Live Oak Bank:

In Q3 2023, Live Oak Bank demonstrated a notable trend in gross approvals by $ amount within the franchise lending sector. In terms of dollar value approved, Live Oak Bank reached $83.5M in Q3 2023, reflecting a commendable financial commitment to supporting franchise endeavors. Furthermore, it is important to highlight that Live Oak Bank has consistently ranked among the top two lenders providing funding to franchise business owners for the past five years. This enduring achievement underscores their well-established presence and trustworthiness in the industry. This long-standing track record of support emphasizes Live Oak Bank’s ongoing commitment to equipping franchise entrepreneurs with the necessary financial resources for their success and growth.

Unlike Huntington, Live Oak Bank’s gross approvals were more concentrated in larger loan sizes ranging from $500k to <$3MM.

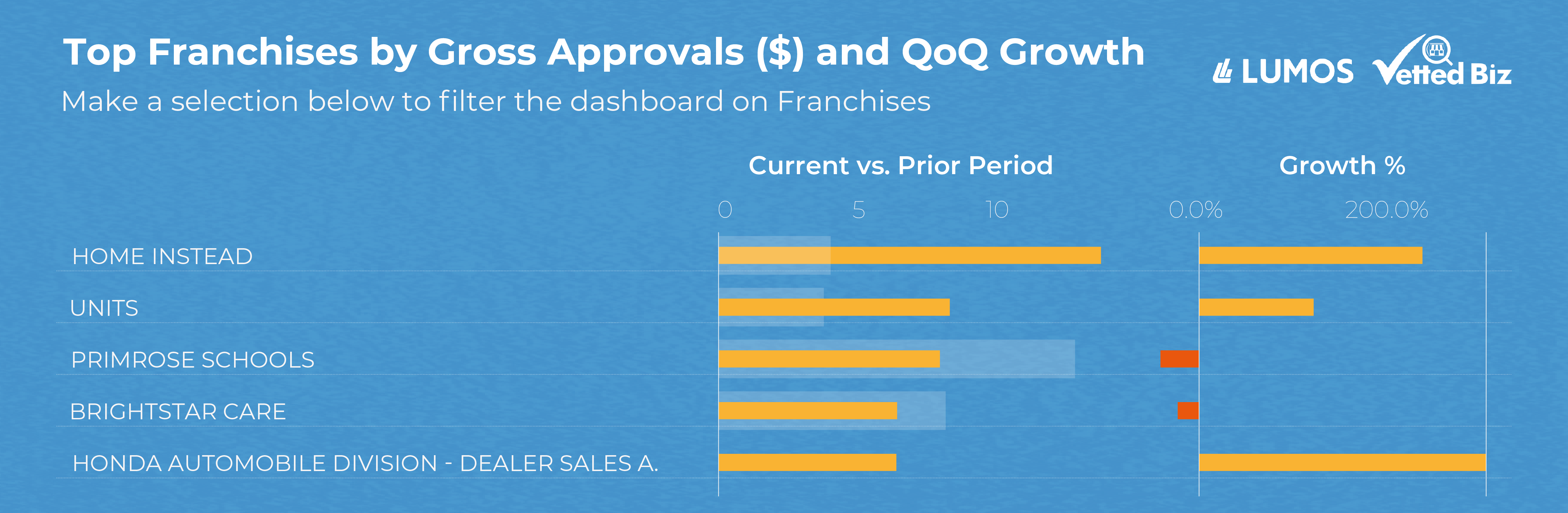

Below, you’ll find the top-ranked franchises based on gross approvals and quarter over quarter (QoQ) growth, with Home Instead claiming the top with $10.6M in gross approvals.

Celtic Bank:

During FY Q3 of 2023, Celtic Bank reached $41.3M in gross approvals, showcasing a substantial financial dedication to bolstering franchise enterprises.

Celtic Bank’s gross approvals were more concentrated in larger loan sizes ranging from $1M to <$3MM. This meticulous approach is evident, as a majority of their loans have been higher dollar amounts, with their average loan size exceeding $2.5 million per loan.

At the pinnacle of the top franchises, based on gross approvals and quarter over quarter (QoQ) growth, stands Boyett Petroleum, closely followed by Sonesta Simply Suites.

Navigating the intricacies of franchise loans can be a daunting task, but armed with the right information and the backing of a reputable financial partner, the path to franchise ownership becomes decidedly more accessible.

What types of loans are available?

SBA Loans

One of the most versatile options for franchise financing is the Small Business Administration (SBA) loan program. Within this program, the 7(a) Loan Program stands as the cornerstone, providing crucial loan guarantees to lenders. The applications for SBA loans are as diverse as the businesses they serve. Whether it’s launching a new franchise, acquiring an existing one, or even refinancing existing debt, SBA loans offer a comprehensive solution.

These loans can cover a range of expenses including start-up costs, equipment purchases, leasehold improvements, real estate acquisitions, working capital, and much more. With loan amounts reaching up to $5 million and flexible terms extending up to 25 years, the SBA program provides substantial financial backing.

Moreover, borrowers can opt for either fixed or floating interest rates based on their specific circumstances and preferences, further enhancing the program’s adaptability. The interest rates vary depending on the loan amount, with options ranging from a variable max rate of Prime + 6.5% for amounts of $50,000 or less, to a variable max rate of Prime + 3.0% for loans exceeding $350,000.

This flexibility ensures that businesses of all sizes and scopes can find the financing that best suits their needs.

Conventional Loans

Conventional loans present a compelling option for businesses seeking financing solutions that offer flexibility and competitive rates. Tailored to meet a spectrum of financial needs, from kick-starting a new venture to acquiring real estate assets, these loans boast a distinct advantage in their ability to expedite the approval process compared to their SBA counterparts.

However, it’s crucial to bear in mind that conventional loans do not carry the government guarantee that SBA loans do, which means that the entirety of the default risk rests with the lender. This often leads to more stringent credit and collateral requirements.

The use cases for conventional loans are extensive, covering needs such as working capital enhancement, refinancing of existing business debt, acquisition, refinancing, or improvement of real estate assets, and even the procurement and installation of machinery and equipment.

Additionally, they can also be used for purchasing furniture, fixtures, and supplies or for taking over an existing franchise. These loans can reach substantial amounts, going up to $5 million, with terms stretching up to 25 years. Borrowers have the option to select between fixed and variable interest rates, depending on the lender’s policies and the borrower’s credit profile. For a deeper analysis on the different types of loan, have a look at this article.

Vetted Biz and Lumos Join Forces for Seamless Funding Solutions

At Vetted Biz, we’ve enhanced our services to ensure you secure the necessary funding for your franchise success. Our upgraded offerings pave the way to financing, customized specifically to your requirements. Bid farewell to the bureaucratic obstacles of traditional banking and welcome the simplicity of seamless alternatives.

That’s why we’ve partnered with Lumos. They’re at the forefront of transforming how businesses utilize financial insights to reach their objectives. Through their state-of-the-art platform, you’ll gain access to priceless data and predictive models that will illuminate your franchise venture’s journey toward sustainable growth. With Vetted Biz and Lumos by your side, you’ll have the tools and assistance to transform your franchise vision into a thriving reality.

Are you prepared to set out on your franchise journey with the perfect funding program? Complete our form now, and let’s uncover the ideal solution tailored just for you. Your road to success commences right here.

Conclusion

In conclusion, venturing into franchise ownership is an exhilarating journey, brimming with the potential for success and financial prosperity. Yet, securing the right financing is paramount in transforming this vision into a tangible reality. Through a thorough examination of these institutions’ offerings, it is clear that every lender dedicated to America’s small business franchise owners holds a prominent position in the industry, offering specialized loan solutions to cater to the distinctive requirements of franchisees. A heartfelt shoutout goes to each of these lenders for their invaluable contribution in helping borrowers pursue the dream of owning their own franchise. Their unwavering support paves the way for countless entrepreneurs to thrive and prosper in the world of franchising.