Cinnabon

Business Plan with Financial Model

Restaurants & Food - Desserts

Powerful Tool for Success

Our meticulously designed franchise business plan and financial model empower you to make informed decisions about potential franchise investments, providing a clear path to success.

Financial Projections

Estimate the outlook of your franchise investment.

Business Planning

Establish a solid foundation for your strategy.

Equity Raising

Present a compelling case to potential investors.

SBA Loan Applications

Navigate the loan process confidently.

How to benefit from the model?

For potential franchise owners and investors seeking clear financial insights, this easily accessible model is designed for individuals with basic financial understanding.

User-Friendly Input

Easily input data, even without

financial expertise.

Tailored Projections

Customized for each franchise,

maximizing relevance.

Insightful Analysis

Delve into clear revenue, expense,

and profitability projections.

Decision-Ready Data

Gain confidence for informed financial

choices.

Detailed Explanations

Notes and videos clarify line items,

calculations, and inputs.

What’s inside

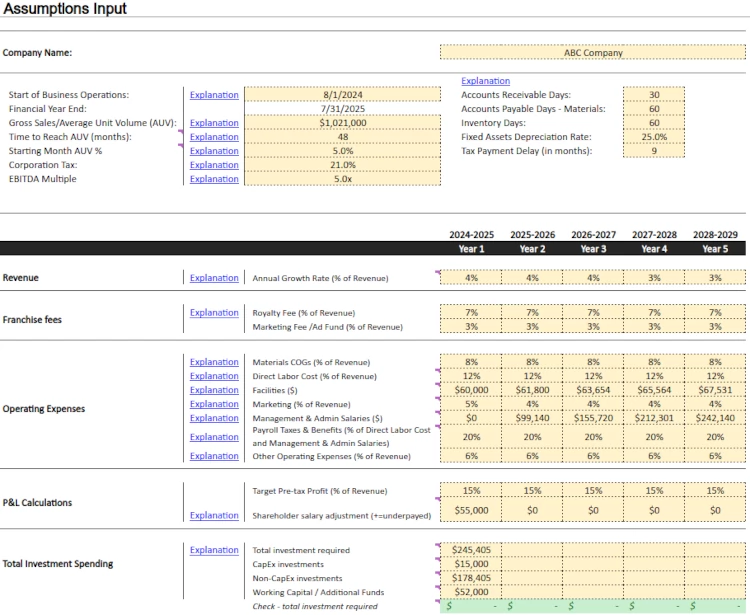

Input Assumptions

Our Cinnabon business plan financial model gives you full control to input any assumptions you have when evaluating an investment in Cinnabon.

The Vetted Biz model can power your franchise investment insights and help you secure funding. We aimed to provide as much flexibility as possible when making the assumptions so that you can see all of the different scenarios for an investment in Cinnabon.

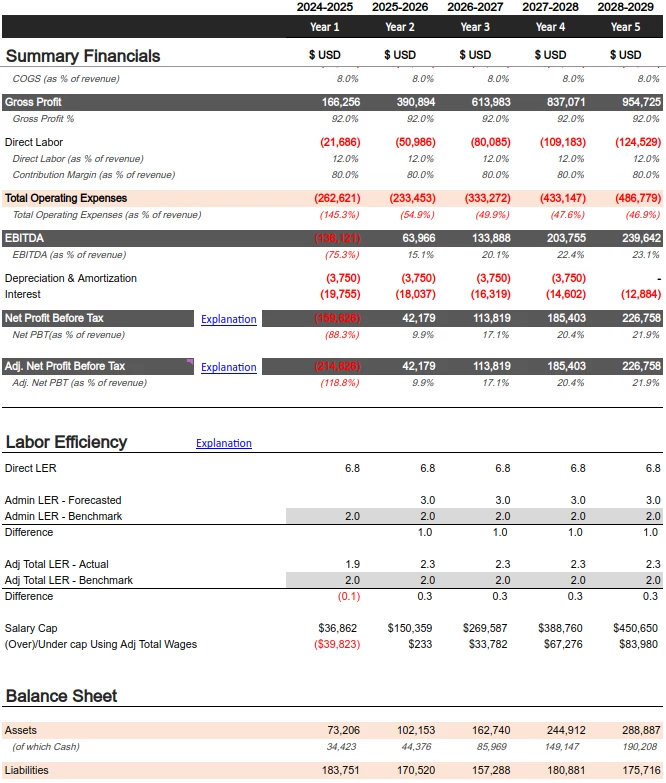

Summary Financials

The Cinnabon business plan template created by Vetted Biz has a summary financials sheet where you can see a summary projection of every key financial when evaluating owning a Cinnabon unit. This includes the P&L statement, Labor Efficiency table, balance sheet, cash flow statement, breakeven analysis, payback period analysis, returns on invested capital (ROIC), and valuation.

The Vetted Biz franchise business plan is the best place to see all of these potential scenarios before you make any investment decision.

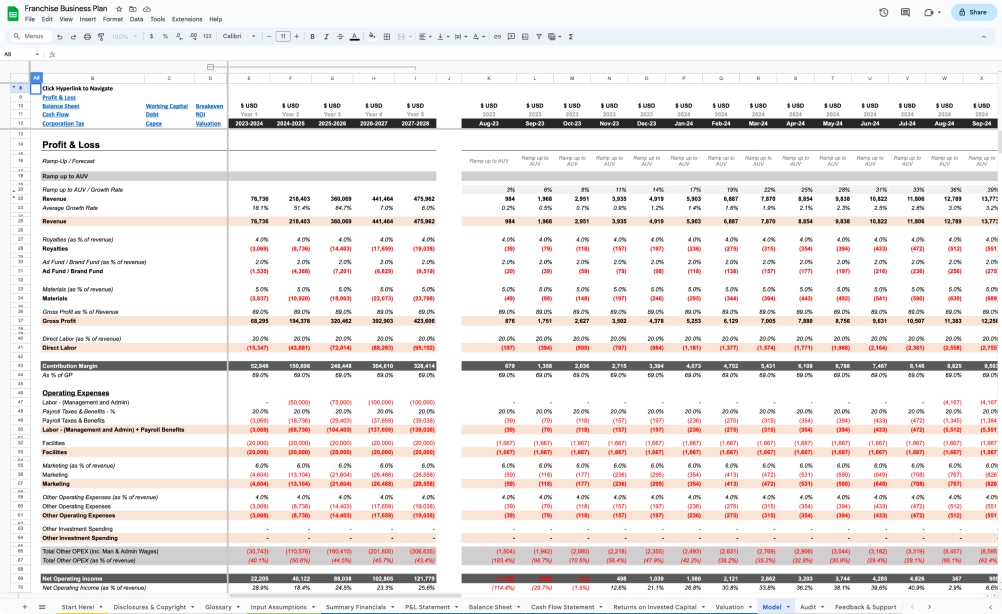

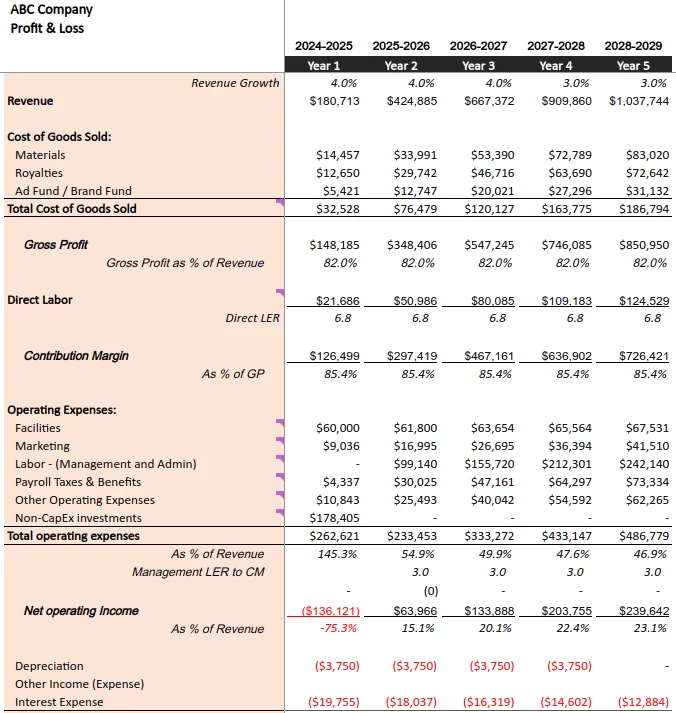

Profit & Loss

Before investing in a franchise you will want to know the potential profits an owner of Cinnabon can make or earn. The Cinnabon business plan has a profit and loss (P&L) statement that is uniquely structured with the eye of a potential business owner in mind.

The P&L is indispensable in a franchise unit business plan as it provides a detailed overview of the potential gross sales, expenses, and profitability over a specific 1-year periods. The model for Cinnabon helps franchisees and potential investors understand how the business may perform, highlighting the most important revenue and cost categories.

The P&L statement is crucial for budgeting and forecasting, enabling potential franchise business owners to make strategic decisions to enhance profitability. Finally, it's essential for demonstrating the business's financial viability to lenders and investors, supporting efforts to secure funding.

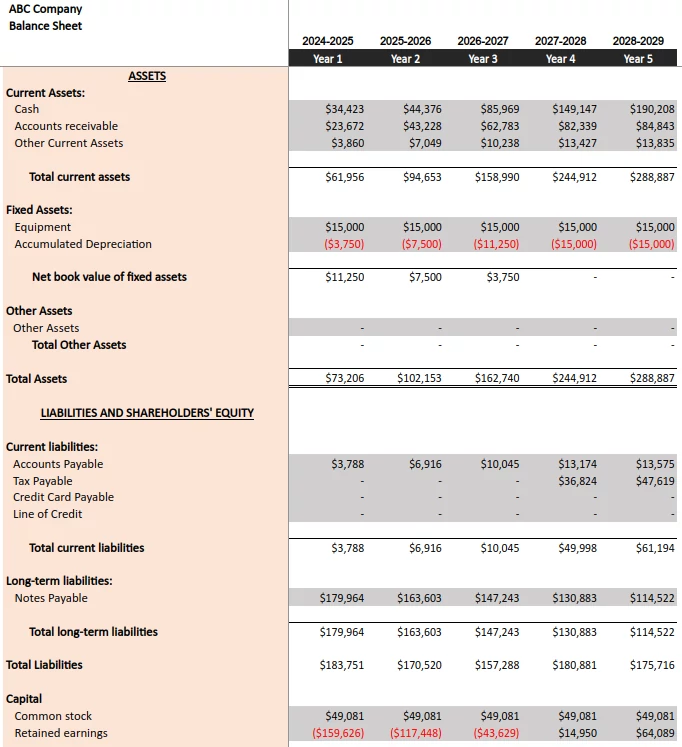

Balance Sheet

The balance sheet in the Cinnabon business model is crucial for any potential franchisee as it provides a clear snapshot of the company's financial health. The balance sheet details assets, liabilities, and equity, offering insights into the business's net worth at a specific point in time.

For potential investors and lenders like yourself, a forecasted balance sheet demonstrates potential fiscal responsibility and stability, essential for securing financing and sustaining growth. Additionally, it aids potential Cinnabon franchise owners in making informed decisions about future investments and expense management.

Cash Flow

The cash flow statement for Cinnabon is vital to forecast in the franchise business plan as it tracks the potential cash entering and leaving the business, offering a transparent view of liquidity and operational efficiency.

This financial statement helps identify how well the business can manage its cash to fund operations, pay debts, and invest in growth.

It is essential for planning and ensuring that you have enough cash on hand to meet your obligations, particularly in the early stages of development. Additionally, a clear cash flow statement is crucial for attracting investors, as it demonstrates the business's ability to generate cash and sustain its operations.

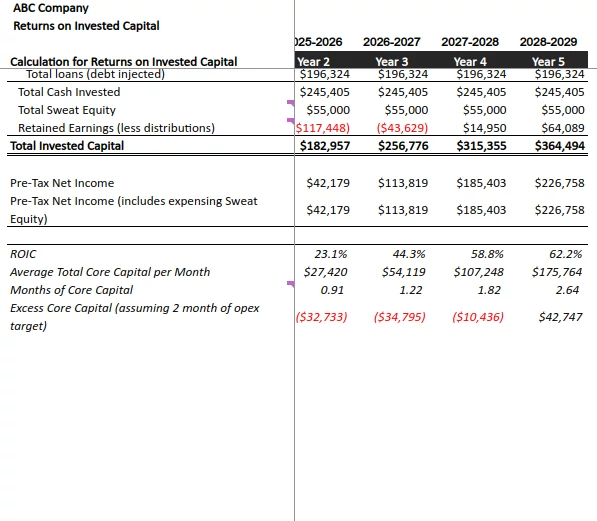

Returns on Invested Capital (ROIC)

The returns on invested capital is one of, if not the, most important calculations that you should do before doing any investment into a franchise or small business.

In the franchise business plan for Cinnabon, you can calculate the potential returns, or ROIC, based on the amount of capital invested into the business against the total net income generated from the business.

We take a unique approach in this model to account for potential sweat equity (cases where you may underpay yourself to help bootstrap the business) and required core capital so you have as accurate a picture as possible of your potential returns on a franchise investment.

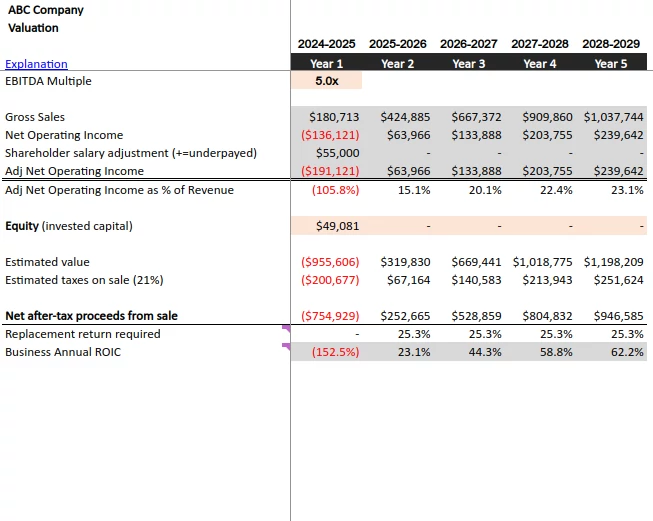

Valuation

Would you like to know the potential valuation of an investment in a Cinnabon unit? There are two key primary inputs in the model: the EBITDA multiple and the adjusted net operating income.

Our model helps you calculate the true adjusted net operating income so you can have a good idea as to what the potential valuation of a Cinnabon investment.

Our model is unique because we also include the “replacement return required” so you have a good idea of what sort of return you would target for if and when you decide to eventually exit or sell your franchise.

Frequently asked

questions

Have some doubts? See the most frequently

asked questions

Absolutely! Our franchise business plans are designed to be user-friendly and pre-built, making them accessible even if you're not an Excel expert.

Key Features:

- Easy-to-Use Templates: Our templates are straightforward and require minimal Excel knowledge.

- Tutorial Included: We provide a comprehensive tutorial to guide you through using and customizing the template.

- Editable Assumptions: You can easily change assumptions without worrying about breaking the template.

Yes, our financial model templates are ideal for meeting your bank's financial plan requirements.

How our franchise business plans can help:

- Comprehensive financial plans: Our templates include 5-year financial projections for your Profit-and-Loss statement, Balance Sheet, and Cash Flow statement.

- Versatile formats: Easily generate both PDF and Excel versions of your financial plan to meet different lender requirements.

Lender requests may include:

- Profit-and-loss statement: Essential for most financial plan requests.

- Full financial statements: Some lenders require all three major financial statements.

- Projection periods: Typically, banks ask for 3 to 5 years of financial projections.

- Document formats: While some banks accept PDF summaries, many prefer the underlying Excel files for detailed analysis.

Yes we support potential and current franchisees with financing.

Please visiting our financing page here to fill out the application form.